Annual Report 2022 Annual Report 2023

GREETINGS

Interim Chief Executive Officer

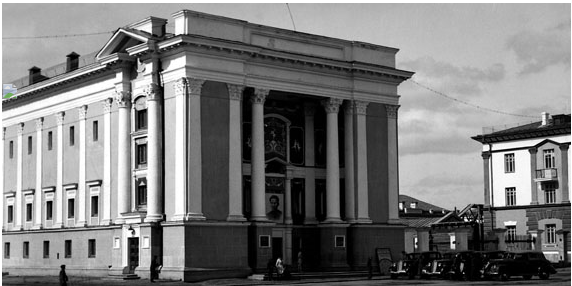

MONGOLIAN STOCK EXCHANGE

MUNKHBAT Davaatseren

Dear investors, market professionals, and valued clients,

I am pleased to extend my warm greetings to you.

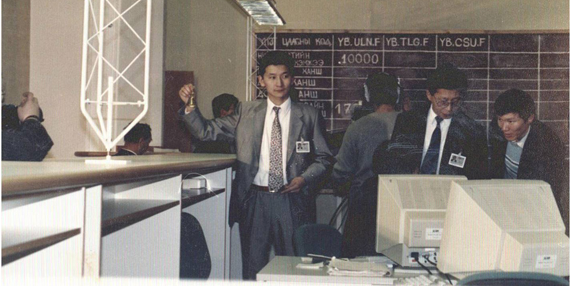

As we approach the 35th anniversary of the establishment and development of the Mongolian Stock Exchange in 2026, we are pursuing a clear strategic objective to further expand our operations and elevate the capital market to a new stage of development.

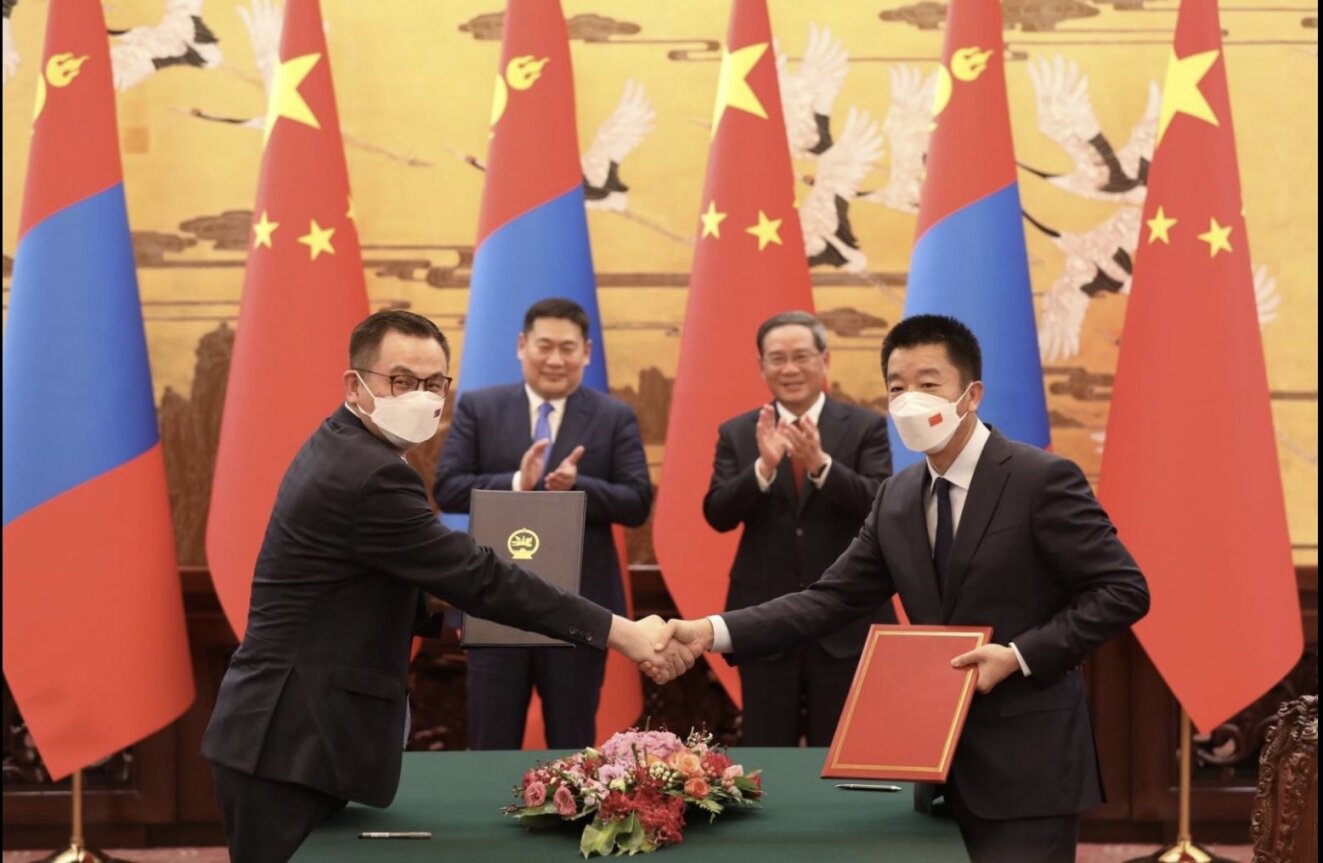

Over the years, the Mongolian Stock Exchange has consistently implemented concrete measures to strengthen market infrastructure, enhance transparency, and broaden access to new products and services.

In 2025, the Mongolian Stock Exchange achieved a historic milestone, with total securities trading reaching MNT 850 billion and market capitalization growing to MNT 13 trillion. The year also marked significant progress in the trading of mining products, the modernization of securities market infrastructure, and the deployment of data center capabilities in line with international standards.

Looking ahead, we will continue to focus on expanding the capital market, improving liquidity, introducing innovative products, supporting IPOs of both state-owned and private sector companies, and strengthening the confidence of all market participants.

On behalf of the management team and our employees, I reaffirm our commitment to working openly and collaboratively with all stakeholders to further develop a transparent, stable, and competitive capital market.

Thank you.